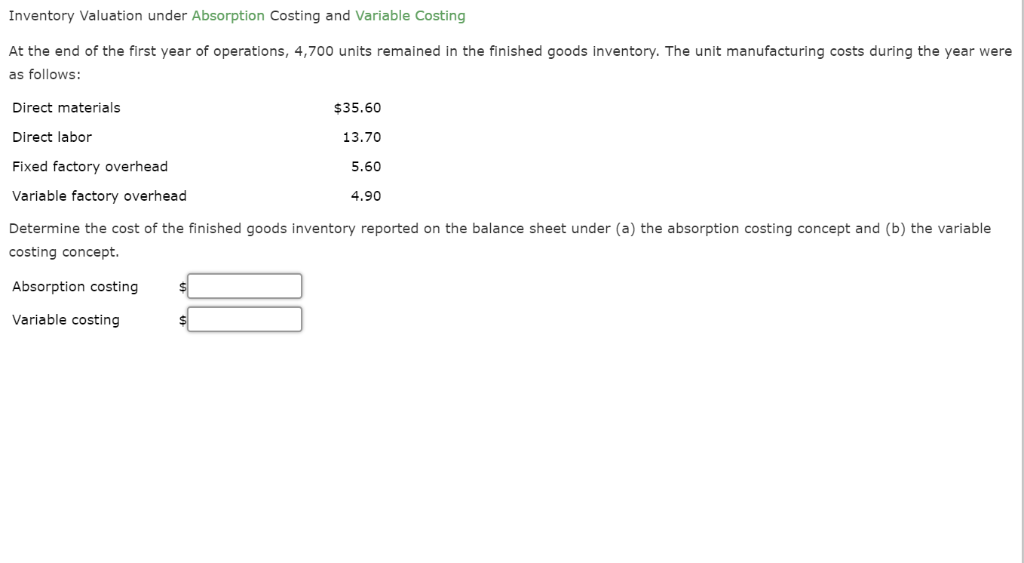

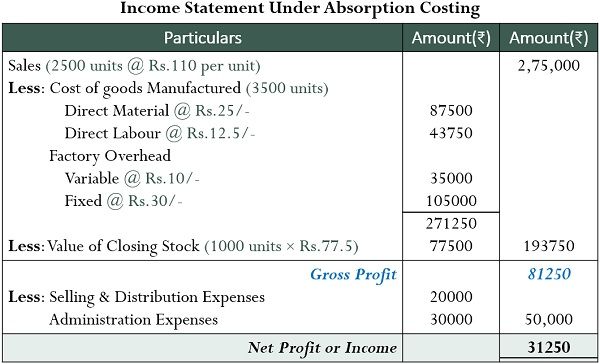

Furthermore, certain overhead expenses get apportioned based on arbitrary criteria. By allocating fixed costs to inventory, absorption costing provides a fuller assessment of profitability. In summary, absorption costing provides a comprehensive view of production costs for improved decision-making, even though net income may fluctuate more goodwill as an intangible asset between periods. Mastering these mechanics can lead to GAAP-aligned and incremental accounting. Variable costing is a valuable management tool but it isn’t GAAP-compliant and it can’t be used for external reporting by public companies. A company may also have to use absorption costing which is GAAP-compliant if it uses variable costing.

How Continuous Innovation Helps Manufacturers Make Great Products?

Maybe calculating the Production Overhead Cost is the most difficult part of the absorption costing method. The following is the step-by-step calculation and explanation of absorbed overhead in applying to Absorption Costing. It also considers all direct costs (i.e. materials, labor, and expenses). The process of such charging to or recovering of the overheads in the cost of production is called overhead absorption. This is the allocation of the cost of machinery and equipment over their useful life. Depreciation is considered a fixed cost in absorption costing because it remains constant regardless of production levels.

- A drop in output, on the other hand, usually means a greater cost per unit.

- Every production expense is allocated to all items, regardless of whether every made good is sold.

- To apply predetermined absorption rates, the actual value (i.E., The actual number of units or any other actual base data such as direct labor hours or machine hours) is multiplied by the predetermined rate.

- It reveals inefficient or efficient production resource utilization by displaying under- or over-absorption of manufacturing overheads.

Which of these is most important for your financial advisor to have?

It further makes it a useful tool for evaluating suitable product pricing. (b) Each component of the product should bear its own share of the total cost. The assignment of costs to cost pools is comprised of a standard set of accounts that are always included in cost pools, and which should rarely be changed.

1: Absorption Costing

To put it another way, all manufacturing costs are absorbed into the price of the finished goods. If 25 hours are spent on a job, then the absorption on the job will be of $0.2 x 25 hours (i.e., $5). This method should be applied when labor is the main factor of production.

Ideally, the quantity and cost of materials in each product are uniform, and processing is also uniform. The overhead rate is applied to determine the amount of overhead to be charged to a job. All products, jobs, or services pass through one or more producing cost centers.

Great! The Financial Professional Will Get Back To You Soon.

The treatment of Overhead expenses is the fundamental difference between variable and absorption costing. Variable costing isn’t allowed for external reporting because it doesn’t follow the GAAP matching principle. It fails to recognize certain inventory costs in the same period in which revenue is generated by the expenses. In February, Higgins produced 60,000 widgets, so it allocated $120,000 of overhead.

Either the difference (either positive or negative) is charged to the cost of goods sold at once, or the difference (either positive or negative) is applied to the relevant cost objects. Consequently, an immediate write-off is usually limited to smaller variances, while the latter method is used for larger variances. Absorption expenses are easy to track because small businesses often do not have a large number of things. It further allows companies to sell their goods at more realistic pricing and profit margin.

The key costs assigned to products under an absorption costing system are noted below. Under this method, prime cost is used as the basis for determining the overhead absorption rate. Overhead absorption is defined as the allotment of overheads to cost units. When the amount of overheads has been determined on the predetermined basis for each cost center, the next step is to charge it to production.

In summary, the overhead absorption rate helps allocate a fair share of indirect overheads to each product based on expected production volume. Variable costing will result in a lower breakeven price per unit using COGS. This can make it somewhat more difficult to determine the ideal pricing for a product. Variable costing results in gross profit that will be slightly higher, resulting in a slightly higher gross profit margin compared to absorption costing. A company must pay its manufacturing property mortgage payments every month regardless of whether it produces 1,000 products or no products at all. It may see an increase in gross profit after paying off the mortgage or finishing the depreciation schedule on a piece of manufacturing equipment.