Help save articles getting later on

While the sharemarket and you may news was abuzz with forecasts regarding whenever interest rates have a tendency to slide, there’s you to very big group maybe not discussing this new excitement: savers.

Many savings membership was repaying interest prices off close 5 percent for around the past year, however the times of these types of yields is positively designated, given that Set aside Lender in closer to cutting the bucks price.

Although not, the fresh Set-aside Bank is not the only prospective way to obtain soreness towards the fresh horizon having savers. Some analysts in addition to believe the economical banking institutions get sooner or later reduce coupons costs by the more whatever decrease the fresh Put aside tends to make on bucks price. Simply put, they think banking institutions might use the fresh defense of Set-aside Bank rates moves to hit savers having awesome-size rate slices.

This new $step 1.5 trillion marketplace for retail deposits and this pulls less scrutiny as compared to mortgage field plays a critical to possess properties and you can financial institutions exactly the same. However, present alter show how the tide is gradually turning to have savers.

Basic, interest rates into the name deposits keeps plummeted, as banking institutions features reacted to sell wagers the new main lender often cut the bucks rates in early 2025. RateCity claims forty banks slash name put costs last times, in addition to huge four have all cut-in latest days. To-be fair, that is how identity deposits really works they’re valued away from sector traditional.

2nd, some big banks features has just fiddled on the prices out-of savings account such that try state-of-the-art and you may likely to service margins.

ANZ has just cut prices for the their on the web family savings, decreasing the base rate paid back so you’re able to established users by 0.1 out-of a share suggest 1.4 percent. At the same time, they enhanced new basic rates (merely taken care of the initial 3 months just after people unlock an enthusiastic account) by equivalent amount of 0.step one regarding a portion area.

Clancy Yeates

Westpac produced a similar changes past week. They slice the base rate on a single of their offers membership because of the 0.fifteen payment facts, while you are improving the bonus rate (and this just enforce if the consumers satisfy certain requirements) of the same number. It means the fresh new headline rate of interest (incentive speed in addition to base rate) try unchanged, however, people who cannot meet with the conditions gets quicker.

ANZ also made a significant difference meaning consumers of americash loans Hammondville the digital offshoot ANZ Including Cut need certainly to see the newest standards to get the most useful rate, meanwhile it nudged in the rate.

These types of users have to today expand the equilibrium of the no less than $100 30 days, leaving out desire, to get the top rate of five percent. In earlier times there were no such as standards, though the ideal price was quite lower, at 4.nine per cent. These change indicate this membership is more like those given by competitors.

Now, speaking of perhaps not enormous changes in this new design of anything. Nevertheless might have noticed such adjustments are very cutting-edge that’s no collision.

All of them examples of what the Australian Competition and you may Individual Commission (ACCC) calls proper prices, and several analysts trust the banks will implement these kinds of solutions to limit the squeeze for the payouts whenever rates slide.

Morgan Stanley’s Richard Wiles told you this new previous Westpac change and the ANZ change to their on line saver was indeed relatively small tweaks, even so they displayed different levers open to banking institutions. He told you there may be an opportunity for deposit repricing to support margins if the Put aside Lender slices costs.

In fact, all of our forecasts assume that the newest RBA can cut costs by the 75 bp [base points] therefore the big banking companies will certainly reduce their incentive savings and you may important offers membership by an average of -40bp and you may -20bp more than the money rate, respectively, Wiles blogged.

Against this, financial institutions may think it is too politically risky to aside-cut the main bank regarding discounts membership specially when discover a keen ACCC query simply a year ago.

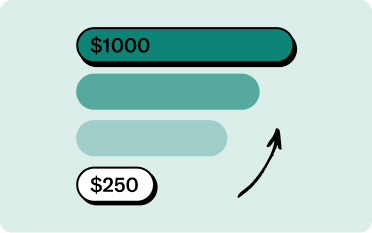

The same, the latest latest changes show exactly how banking companies manage to make the simple savings accounts pretty state-of-the-art. If you need the greater bonus costs, you can easily routinely have so you’re able to dive owing to hoops particularly and work out an excellent lowest level of deposits otherwise expanding your debts each month.

It complexity suits a professional mission. Banking companies however want to limit their costs of repaying interest, nonetheless including count on retail places for almost 30 per cent of the financial support, an average of. So, they compete selectively, centering on sticky deposits which might be less inclined to be taken out of the blue, when you are purchasing reduced to the people who don’t meet with the conditions.

This means we miss out on aggressive rates of interest: the new ACCC this past year said 71 percent regarding users didn’t obtain the bonus speed in the first 50 % of 2023, an average of. The watchdog plus found these measures then complicate industry, it is therefore difficult to compare levels, and people rarely switch banking institutions. All of these serves banking institutions besides.

In reality, banks’ capability to tap reasonable-pricing deposits is a switch chemical in their winnings. Jefferies specialist Matthew Wilson leaves it this way: Although the home loan continues to hog the fresh story, the reality is this new money inhabit dumps. Nevertheless, he issues if the disease try sustainable during the a scene in which cash is much more electronic, just in case environment, personal and you will governance prices get a much bigger say.

Treasurer Jim Chalmers provides vowed to greatly help consumers obtain a good price to their deposit membership, plus in June established changes that resulted of ACCC concerns towards the home loans and you may places.

Government entities usually push banks to tell customers when rates into coupons account changes, also it would like to increase just how banking institutions give users regarding bonus cost, and/or stop away from introductory rates, certainly almost every other changes.

Chalmers sometimes present legislation of these change the coming year that may really coincide which have Put aside Bank rates slices. When those people cuts happen, banking institutions often deal with ferocious governmental tension to pass toward reductions completely in order to mortgage consumers. Savers should also be looking for one repricing regarding less scrutinised market for home places.

The firm Briefing newsletter brings significant tales, exclusive publicity and you can professional thoughts. Join get it all the weekday day.