Repair strategies is going to be fascinating getting home owners, nevertheless they will have significant expenditures. Thus, the majority of people discuss refinancing their houses to gain access to the income it you prefer.

Regardless if you are seeking to alter your roof, grow your living space, or give the deck a brand new lookup, financing will get an essential basis. One solution to imagine is actually mortgage refinancing.

What is actually mortgage refinancing?

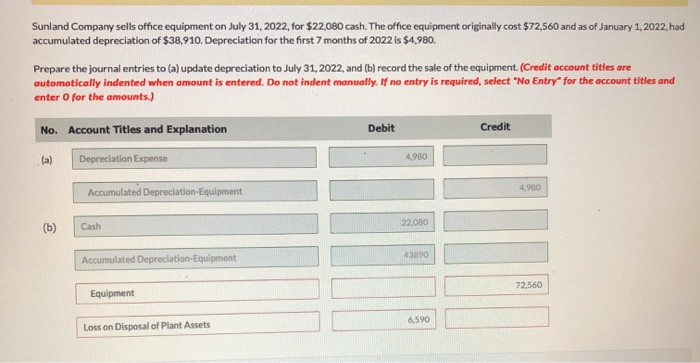

Refinancing a mortgage relates to renegotiating your current mortgage to gain access to most money used to possess strategies instance renovations. The procedure is comparable so you’re able to getting their initially loan.

In order to be eligible for refinancing, you should have collateral in your home. Security is the difference in your own property’s market value plus the left equilibrium on your own mortgage. In the event the equity is lack of, the bank will get deny the application.

Also, it is essential to remember that refinancing usually allows you to use to 80% of your own house’s value, without your a fantastic financial equilibrium.

In this circumstances, you could potentially re-finance as much as a total of $145,000 from your home. Just after your refinancing application is approved, your financial often to evolve your own monthly installments in order to mirror the fresh new loan amount.

Positives and negatives out-of refinancing their financial to own renovations

- Your generally speaking appreciate straight down rates as compared to other financial support possibilities, such unsecured loans otherwise handmade cards.

- The loan is frequently amortized over a longer period, allowing you to create faster monthly obligations.

- Of the borrowing, you could end making use of your own deals, quick assets, otherwise crisis loans.

- Refinancing get cover courtroom charges getting registering the loan and you will possible early installment penalties.

- It is best in the event your renovations often increase property’s really worth if you decide to offer.

- Getting small methods having down expenditures, alternative money possibilities would-be way more beneficial.

Which are the most other financial support options for the home improvements?

Along with refinancing your own financial, there are a few other ways to finance their recovery projects. Check out solutions:

1. Coupons

For those who have some funds away, contemplate using it to own small renovations. Buying materials out-of-pocket helps you avoid the significance of credit and keep maintaining their credit even more down.

2. Charge card

In case your deals aren’t enough to shelter less projects, a charge card are going to be a convenient choice. Try to pay your balance entirely for each day to cease accumulating highest-attention fees.

3. Personal loan

Signature loans normally include down rates of interest than just playing cards. You are able to pay the loan during the normal instalments over a period you to banks in Indiana that do personal loans with bad credit always selections from so you can 5 years.

4. Line of credit

If you have several long-term methods planned, a personal line of credit is an adaptable selection. That one makes you borrow money as required, with interest levels fundamentally less than those of a charge card. You pay attract to your number you employ.

In lieu of a personal bank loan, a credit line allows you to use multiple times up to a predetermined restrict without the need to reapply toward financial.

5. Home security line of credit

A house guarantee credit line offers equivalent advantageous assets to an effective line of credit, but it is protected by the possessions. This will render entry to big amounts of money if you’re tend to offering all the way down rates of interest.

If you’re considering to purchase yet another domestic that really needs renovations, a purchase-renovation financing is advisable. This type of loan makes you range from the costs out-of organized reount, referred to as a remodelling home loan.

7. Gives getting opportunity-productive renovations

In the event your programs work with lowering your ecological impact and effort usage, you could be eligible for offers or rebates. Of many federal and you will provincial governing bodies, as well as municipalities and power organizations, promote financial bonuses to have specific version of times-efficient home improvements. Make sure you talk about these types of potential!

Before choosing your investment option, its required to perform a spending plan. This will help you gauge the total price of renovation functions. At exactly the same time, no matter what ideas you plan, constantly set aside most money to pay for unforeseen expenses.