- Household members properties: earnings eligible property

- Elderly properties: money eligible clients have to have a handicap or perhaps 62 age otherwise earlier

- Combined features: household members and you may older tools in the same possessions

- Congregate attributes: earnings qualified tenants who will be older and want dishes or other functions be provided; it designation isnt intended to operate for example a breastfeeding home, even though there was similarities, very can cost you from wellness attributes are not shielded by this program

- Category construction: earnings qualified renters who are elderly otherwise has a disability; not the same as almost every other elderly designations, products provides common liveable space and an occupant might need a beneficial citizen secretary

Due to the fact the start of Section 515 program, more 550,000 rural rental tools have been developed across the nation. Mortgage prepayments, financial readiness, and you may property foreclosure has faster that it matter to help you 410,000 gadgets at the time of 2016. S. counties and you can, oftentimes, provide the only source of subsidized houses to this neighborhood. Property staying in this type of characteristics keeps the common income out-of $a dozen,588, and you will almost 63 % is oriented by possibly a senior people otherwise just one having an impairment.

Brand new Section 515 Program Evolves

Within the 1974, Point 521, and/or Rural Local rental Direction Program, are passed by Congress. Tenants when you look at the Part 515 developments classified as the very low-earnings or lower-money are eligible because of it local rental assistance subsidy. So it subsidy is a beneficial move across work for comparable to a housing discount program: renters need to pay 30 % of their earnings and you will RD pays the remainder rent matter right to the proprietor. Part 521 can be regarded as an incentive to save owners inside the the brand new Part 515 system. However, allocations to that rental guidance are susceptible to Congressional acceptance North Carolina local banks for personal loans, appropriations vary per year, in addition to system has never been totally funded to cover all the who will be eligible, hence performing good tenuous disease for renters exactly who located so it leasing guidance.

The fresh RD Voucher Program try approved in the 1992, but don’t discover financial support until 2006. The RD voucher matter is set in the course of prepayment otherwise property foreclosure when ount never transform, meaning tenants must pay one variations because of book develops, despite money change. Clients located in Area 515 services in which the mortgage loans was nonetheless maturing commonly entitled to these coupons.

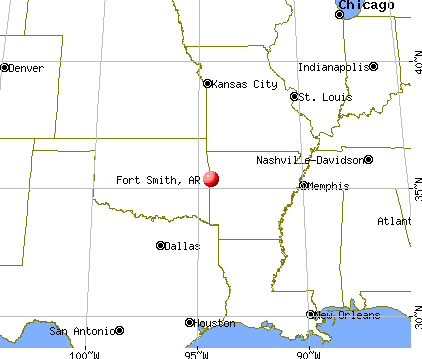

Area 515 services are in 87 percent of all of the You

The brand new supply from the Area 515 System enabling prepayment of one’s financial lets owners of services regarding 515 system to leave the application very early, potentially ultimately causing improved rents to own renters and you can harmful tenants’ homes balance. Congress enacted individuals laws regarding 1979 so you’re able to 1992 to help you stave off these types of damaging consequences:

- 1979 : Most of the improvements financed just after December 21, 1979 had a beneficial 20-12 months fool around with maximum (15-12 months fool around with maximum in the event the Local rental Recommendations wasn’t accustomed subsidize rents.)

- 1988 : The fresh Disaster Low income Housing Maintenance Operate of 1987 (ELIHPA) is meant to prevent the displacement out of tenants due to the new prepayment consequences. Prepayment constraints was indeed wear most of the improvements financed in advance of December 21, 1979. Remember that the newest prepayment constraints dont avoid the prepayment of the loan, but rather need incentives be provided because of the RD towards the holder. The latest bonuses is encourage the customers to stay in the program for the next twenty years. In case your owner refuses the deal, the fresh prepayment procedure comes into a series of tips so that the renters is actually safe. Particularly, section of this step is sold with choosing in the event that there will be a good negative effect on minority homes opportunities.

- 1989 : Use and you will prepayment constraints had been enacted for the full-term out-of the loan for all improvements financed immediately following December 14, 1989. So it, in essence, avoided the fresh prepayment of the mortgage loan. Due to the fact money when you look at the Area 515 program have been forty otherwise fifty season terms and conditions, the length of the loan is quicker so you can thirty years, and you will greet an extra 20 season revival.