Licensed services professionals, veterans, in addition to their partners can obtain property using this loan program. There are no deposit otherwise home loan insurance criteria, and you will get a competitive rate of interest.

Va cash-away refinance

Looking for to help you change your household? Up coming a funds-out refinance may be worth examining. Certified consumers is capable of turning a number of the guarantee for the bucks, that they can then play with to own improvements and repairs.

Virtual assistant streamline refinance

Let’s say you already have an adjustable-price financial. In the place of chance that have a higher payment down the road, you could potentially transition to a predetermined-rate mortgage using a streamline re-finance. We have an entire post intent on the brand new Va IRRRL Domestic Refinance Program.

Eligibility to own a Virtual assistant mortgage

Is eligible, your or your spouse should have offered one of several after the requirements lower than and be discharged properly.

House occupancy conditions

According to Va Loan and you may Guaranty guidance, “legislation needs a seasoned getting a good Virtual assistant-guaranteed loan to certify that he or she intentions to invade the house or property as his or her household individually.” Hence, home buyers bringing a good Va mortgage have to live-in our home because their no. 1 household.

However, immediately after a specific time, this new Virtual assistant lets an effective borrower’s former no. 1 house to get rented away. In such a case, individuals may not have to re-finance from the Virtual assistant mortgage as long as they end up being implemented otherwise features a long-term alter out of channel to some other station.

Quite often, home occupancy need to be satisfied in this two months of your own financial closure. Proof first home is along with requisite.

Conditions on legislation

Army participants can alive more difficult lifetime than simply extremely, so are there informal times when house occupancy legislation might be curved.

Deployed service affiliate: Provider people that deployed using their responsibility route are permitted to get a property in their place of long lasting household.

Lover and you can/or built child: Certain effective military members was Va loan qualified but are towards the productive obligation and out of its permanent residence. If this sounds like your situation, the newest mate otherwise situated child of your own services user can reside our home and you will match the occupancy requirements.

Together with, whether your Va family buyer has stopped being on the military it is temporarily aside having really works-related factors, a wife otherwise established youngster can be fulfill the family occupancy needs.

Retiring https://paydayloanalabama.com/talladega/ services representative: If the a help member preparations to your retiring within this 12 months shortly after obtaining an excellent Virtual assistant mortgage, capable negotiate to possess an afterwards circulate-in the time. An effective retiring experienced need are a duplicate of the advancing years application and you can senior years earnings for Va loan providers to take on the latest consult.

Do-it-yourself: Particular belongings funded which have Virtual assistant financing need fixes or improvements. Should this be the outcome, brand new practical lifetime of requested home occupancy are going to be lengthened. Although not, Virtual assistant homebuyers must approve their purpose so you can consume or reoccupy upon end of one’s advancements.

Uncommon affairs: If for example the circumstance doesn’t meets one of several more than facts, you could potentially submit a description of your own instance to your Virtual assistant for acceptance.

As the Virtual assistant now offers these exclusions, loan providers have their unique standards which could apply at house occupancy requirements. Plan a scheduled appointment that have a qualified Va bank particularly Western Capital to make sure.

Underwriting criteria

Loan providers are apt to have inner criteria regarding Virtual assistant financing fico scores. Very lenders require a candidate having a credit score out of 620 or more.*

Individuals together with need to tell you enough money to repay the house mortgage and you may should not keeps much loans stream. Va loan assistance are a whole lot more flexible than many other loan products to support eligibility. Instance, veterans can use their home loan gurus annually or a couple of once personal bankruptcy otherwise property foreclosure.

As of 2020, there’s no restriction into the Virtual assistant loans. Financing limits in past times ranged by the county and you will was in fact according to median home prices.

Virtual assistant financing Certification out of Eligibility

Lenders wanted proof of eligibility before applying to possess an effective Virtual assistant mortgage. Applicants need to rating a certificate from Qualification (COE) and you will meet with the qualification standards i touched to your before.

An alternative advantageous asset of Virtual assistant finance ‘s the advice and you can guidance provided so you’re able to struggling consumers. The Virtual assistant normally negotiate with the bank for this new debtor in case there are difficulty and provide financial information. Their counselors may help borrowers negotiate payment agreements, mortgage changes, or any other choices to property foreclosure.

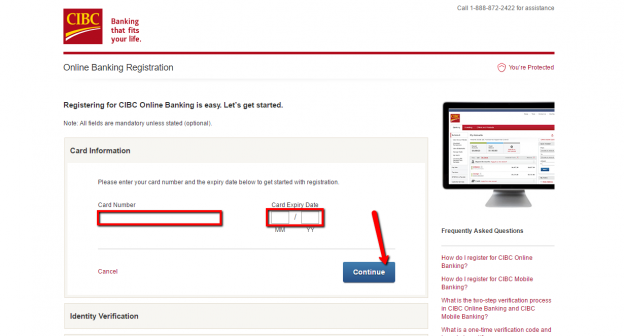

How do i use?

After you have their certification from qualifications (COE), you could potentially make an application for brand new Va financing. The application techniques is straightforward which have American Funding. Our company is a surfacing member of brand new VA’s range of ideal three hundred mortgage lenders and you can dedicated to getting reasonable houses for the armed forces people. Get the most from the Va financing professionals that have Western Funding and contact united states now!

*Virtual assistant mortgage requirements is subject to alter. Right down to COVID-19, home loan traders cannot assistance as much funds, definition underwriting direction to have authorities fund are getting stricter.